Mar 20, 2024

How to calculate Customer Lifetime Value (LTV)

If you want your app to endure and grow, one of the most important metrics you should be aware of is Customer Lifetime Value (LTV). Developing enduring relationships with your clients is more important than simply making quick cash. LTV demonstrates how much a customer will spend and how much you will learn over the course of using your product.

Being aware of the metric is one thing, of course. Ensuring that it continues to grow is an entirely different skill. We go through the specifics of calculating, benchmarking, and growing the lifetime value (LTV) for SaaS products in general and subscription apps in particular in this guide. Our goal is to provide you with useful knowledge and motivate you to continue working on your project. Now let's get going!

Customer Lifetime Value (LTV)

The concept of customer lifetime value, sometimes shortened to CLV but more commonly known as LTV, refers to the total amount of money a company will earn from a customer over time. The total revenue a customer generates from the moment they register with your product until the day they delete their account is more important than any single sale or subscription.

It is crucial to consider the length of time and the amount of money that patrons spend with you. Maintaining good customer experiences and making ongoing improvements are key components of long-term relationship building. Longer customer stays translate into more revenue for the company.

Because of this, LTV typically informs choices about how to improve the product, where to allocate marketing budget, and what attracts and retains customers (or drives them away and ceases spending). Understanding this vital indicator enables you to make prudent financial decisions and ensures that you're investing in things that will generate revenue.

Knowing their LTV aids in the big picture for Software as a Service (SaaS) companies, which is essentially what subscription apps are to end users. Gaining new users is not enough; maintaining current users' interest and getting them back to the app is crucial. SaaS models rely on recurring subscriptions and long-term customer interaction, in contrast to traditional sales models where the value of a product is realized in a single transaction. By measuring not only what a customer spends today but also what they will contribute financially over the course of their relationship with the service, LTV throws light on each customer's long-term value.

Why is LTV important for subscription apps?

Publishers can better understand the true value of their customers beyond the initial sign-up or monthly subscription fee by having a solid understanding of LTV for subscription apps. It pushes businesses to prioritize excellence in customer service, product enhancement, and long-term customer satisfaction. The secret is to look at things long-term because, in subscription business models, keeping existing customers is frequently more economical than finding new ones. High LTV indicates a sound, long-lasting business model where clients find the service to be continuously valuable, resulting in recurring income streams.

Your app's lifetime value should be taken into consideration when making strategic choices. For example, developers can more efficiently allocate resources to areas where adding features or enhancing customer support can significantly increase LTV, based on analysis results. Developers can guarantee a consistent revenue stream and make more confident investments in future growth by concentrating on raising the lifetime value of each client. Building a devoted customer base is essential for long-term success in the cutthroat app market, and it is facilitated by placing more emphasis on customer retention than on acquisition.

LTV is a guiding concept rather than just another industry metric because of this. It emphasizes how crucial it is to see clients as enduring partners as opposed to sporadic purchasers. Understanding and optimizing LTV is essential to fostering customer relationships, making wise strategic decisions, and attaining sustainable growth in a business model that depends on subscriptions and customer loyalty.

What metrics do you need for LTV?

A subscription app setting's LTV is determined using a number of important metrics. The fact that they can indicate significant shifts in LTV makes tracking them crucial in and of itself.

The Average Revenue Per User (ARPU) metric calculates the average amount of revenue generated by each customer over a given time period. This metric is calculated by dividing total revenue by the number of customers over a given time period, such as a quarter or a year. ARPU is important for LTV because it serves as a baseline for determining how much revenue a customer generates on average.

Customer Lifetime (CLT) is the average duration of a customer's subscription and payment for your SaaS product. This metric varies significantly between businesses and is influenced by how well they retain customers. It is calculated using a customer's average tenure before churn.

Customer Churn Rate represents the percentage of customers who cancel their subscriptions: essentially, 1 minus Retention Rate. This metric is critical for calculating LTV because it has a direct impact on the customer's lifetime: the lower the churn rate, the longer an average user will spend with the app, increasing their lifetime value. The metric is calculated as a percentage: simply divide the number of customers lost during a given period by the total number of customers at the beginning of the period, then multiply by 100%.

The term "customer acquisition cost" (CAC) refers to the total cost of acquiring a new client, including sales and marketing costs. Even though it isn't utilized directly in the fundamental LTV computation, knowing a customer's profitability requires it. For a business to be considered sustainable, it is ideal for the LTV to surpass the CAC significantly.

Rate of Discount. A discount rate is used to account for the time value of money in more complex LTV calculations, particularly those that include future revenues. This is especially important for subscription apps that have large up-front costs, significant customer acquisition expenditures, and less frequent (like annual) recurring revenue. A more realistic view of a customer's value is obtained by converting future revenue into present value using the discount rate, which is typically the inflation rate or a derivative of it.

Subscription app developers can use these metrics to calculate their customer base's lifetime value (LTV). Now that we have them at our disposal, let's discuss various calculation techniques in more detail in the following section of this tutorial.

How to calculate LTV for SaaS business?

Simple Method

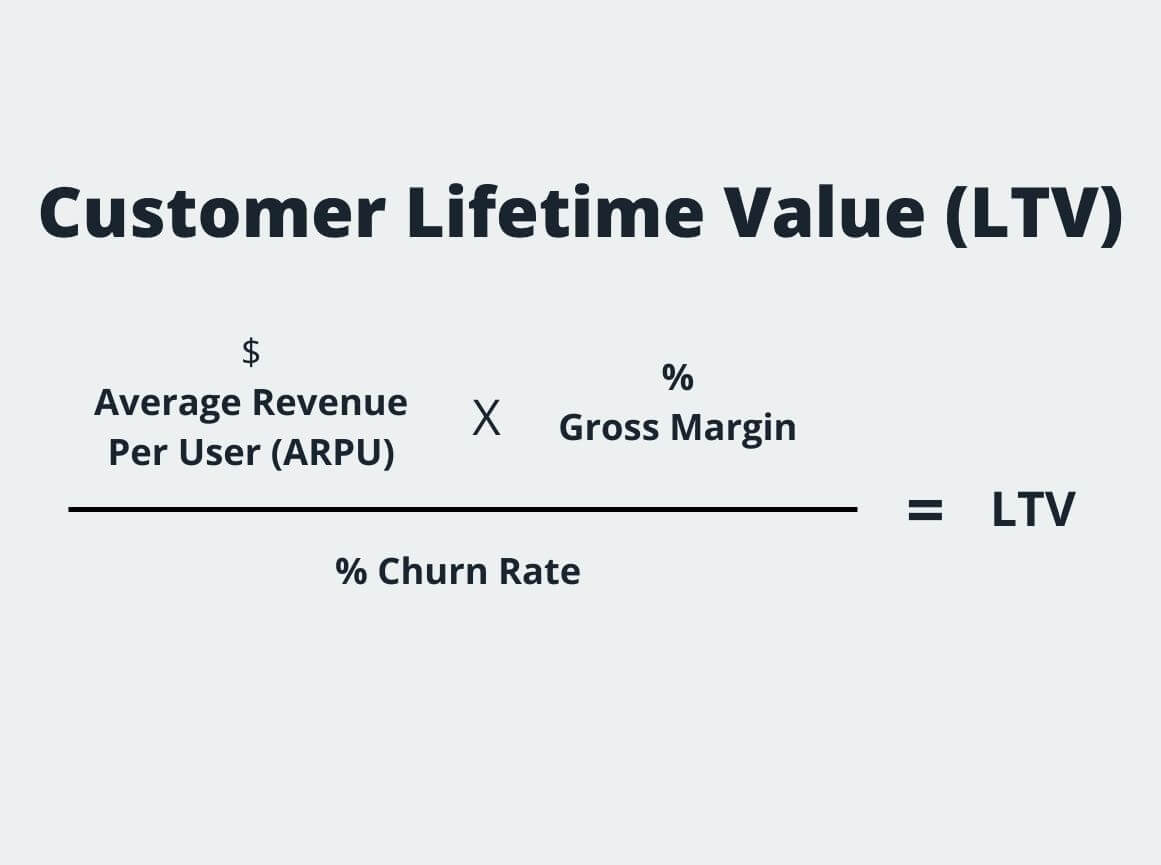

The straightforward method for calculating LTV involves three key metrics: Average Revenue Per User (ARPU), Customer Churn Rate, and Customer Lifetime. Here's the formula for this method:

LTV equals ARPU x Customer Lifetime, where:

ARPU (Average Revenue Per User) is calculated by dividing total revenue by the number of customers in a given period. Customer Lifetime is equal to 1/Churn Rate.

Here's an example. In a given month, you acquired 100 new users and lost 20 by the end of the month. You earned a total of $20,000 in revenue that month. Plugging the numbers into the formula yields:

To calculate the lifetime value of a customer, divide the average revenue per user (ARPU) by the churn rate (20%). Using a customer lifetime of 5 months, the lifetime value is $200 multiplied by 5 = $1000.

A minor but significant change to the model could be to account for the customer acquisition cost (CAC): how much money you spent acquiring this user. For example, if it costs you $50 to acquire a new customer, the actual LTV could be $1,000 - $50 = $950.

Advanced Method

The advanced method incorporates the discount rate for the time value of money, reflecting the principle that money today is worth more than it will be in the future. This is better suited to long-term projections and can provide a more nuanced understanding of LTV. The formula is:

LTV = t=1n ARPU (1-Churn Rate)t-1 (plus the discount rate)t, where t is a time period (typically a month) and n is the total number of periods for which revenue is expected.

Do not be afraid of how the formula appears. The notation simply stands for sum, as we want to calculate the year-long Lifetime Value while accounting for seasonal differences. Essentially, we calculate the LTV using a simple method 12 times (once per month) and then add the results, accounting for inflation and other expenses.

Let's use the same example, but with a 0.5% discount rate (which is common because a country's effective annual inflation rate can be 6%). We'd need something like Google Sheets or Excel to calculate it correctly, and the updated LTV is around $912.

Calculating LTV with Adapty

Naturally, the more precise your LTV forecasts need to be, the more intricate the formulas will need to be, and the more sophisticated the computation tools need to be. Here's where Adapty becomes useful.

The industry standard for subscription app monetization is Adapty. With no-code solutions, developers can considerably reduce the complexity of paywall rollouts and increase revenue by continuously enhancing the performance of their apps and cutting production costs. You can identify the paywall that converts better and attracts more paying clients by conducting frequent AB testing.

Subscription analytics, however, is yet another fantastic feature of the service. Because Adapty has a direct connection to the Play Store and App Store, it can provide extremely accurate data reports. In addition to tracking important business metrics like revenue, retention, and average revenue per user, it analyzes cohorts, or audiences gathered over a specific time period.

On the other hand, the recently released LTV predictions are more significant. Based on the history of your app and the behavior (frequency and size of purchases, the percentage of paying customers) of your user base, Adapty employs a number of machine learning algorithms and continuous updates to provide a value that is as accurate as possible.

To incorporate this technology into your app, begin using Adapty.

What is a good LTV for subscription apps?

A "good" Customer Lifetime Value (LTV) varies by app vertical and takes into account a number of factors, including business model, market segment, product type, and, most importantly, Customer Acquisition Cost (CAC). We'll provide some benchmarks later in the article, but here are the most important factors to consider.

LTV to CAC Ratio

The LTV to CAC ratio, also known as ROMI (return on marketing investment), is a critical benchmark for assessing LTV. This ratio ensures that the cost of acquiring a customer is significantly less than the value generated by them, indicating a healthy, scalable business model. A "good" LTV should be at least three times the CAC, but lower numbers are acceptable during the first months of your app's market presence.

Business Model and Pricing

A subscription app's business model and pricing structure are equally important. For example, apps with high-value, enterprise-level solutions may have a higher CAC but a significantly higher LTV due to higher contract values and longer customer lifetimes. Again, the gain-loss ratio and its stability (or even growth) are more important.

Market Segment and Product Type

Different market segments and product types can have an impact on what constitutes a good LTV. Niche products for specific industries may have a higher LTV due to specialized needs and less competition. In contrast, more generic products in highly competitive markets may struggle to achieve comparable levels of customer loyalty and value. The only exceptions are mobile games, which are growing at a slower rate.

Customer Retention and Expansion

A high LTV indicates strong customer retention and potential for account growth. Subscription apps that provide additional value through upsells, cross-sells, or premium features have the potential to significantly increase customer lifetime value. High retention rates and the ability to grow customers over time indicate that an app provides ongoing value, resulting in a higher LTV.

To summarize, a good lifetime value is often determined by a variety of factors, including the LTV to CAC ratio, business model, market segment, and retention metrics. When benchmarking, compare yourself to your industry peers and their subscription prices.

More on the LTV to CAC ratio

The LTV to CAC ratio for any app demonstrates how effectively marketing spend is converted into profitable customer relationships. Subscription apps must also consider the length of their customer relationship, which directly correlates to revenue, so it is in their best interests to keep the user engaged and motivated for as long as possible. Conversely, you can afford to spend a little more money attracting a customer or a player if you know they will 'pay you back' by remaining loyal to you and the subscription.

This is an important consideration when launching an ad or user acquisition campaign. Marketing frequently sees only the short-term benefits and focuses solely on the cost per install (CPI), without considering the quality of the install. A seemingly more expensive install (such as from an influencer) frequently results in a more informed and motivated customer who is more likely to subscribe. Cheap installs from paid ads, on the other hand, may not always result in paying customers.

That's why paying attention to this ratio rather than the raw numbers is critical: it shows whether your customer acquisition strategies are effective. Of course, if you're spending more on acquisition than you're earning from customers, your business may not be sustainable in the long run; however, give yourself some time to see a return on your investment and focus on upselling existing customers.

As previously stated, an ideal LTV to CAC ratio is at least 3:1, which means you earn three times what you spend to acquire customers. This sweet spot demonstrates that your customer acquisition strategy is both effective and profitable. A ratio of 2:1 is on the lower end but still acceptable, indicating that your business is profitable but has little room for additional expenses or errors.

Tips to increase customer lifetime value

Increasing the lifetime value of your app can be achieved through a variety of practical strategies:

Increase the product's value. Regularly update your app to incorporate customer feedback, add new features, and ensure smooth operation. Continuous product improvement, like gardening, keeps customers engaged and satisfied.

Enhance the customer experience. Make every customer interaction enjoyable, from signup to support. Provide personalized service, easy-to-use design, and proactive engagement to make customers feel valued and supported.

Introduce upselling and cross-selling. Introduce customers to new features or premium plans that will complement their current usage. Make sure these subscription offers are relevant and valuable in order to encourage upgrades.

Focus on customer retention. It is less expensive to keep existing customers than to acquire new ones. To keep customers engaged and loyal over time, implement loyalty programs, discounts for longer-term subscriptions, engaging content, and community-building initiatives.

Leverage data for decision making. Analyze customer behavior, feedback, and usage patterns to make informed changes to your product and customer experience. Data-driven strategies lead to more effective LTV improvements.

While these strategies may appear to be universal and vague, many 'unique' problems with specific apps frequently fall into one of these categories. When you focus on a subscription offer, try to determine where customers 'fall out' of the funnel, and you will notice that it is frequently due to a lack of value or an unpleasant experience.